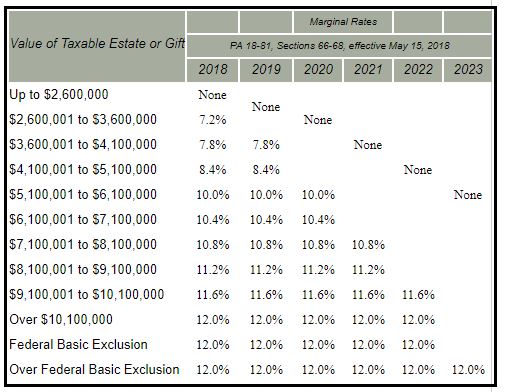

massachusetts estate tax table

Up to 25 cash back If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate. 18 rows Tax year 2022 Withholding.

Channeling Lewis Carroll Connecticut Estate And Gift Tax Tables Are Still Unclear Lexology

First start with calculating your taxable estate.

. How is the state estate tax calculated in. Here is the current progressive tax rate structure currently in place for the Massachusetts Estate Tax Table B Computation of Maximum Credit for State Death Taxes. Massachusetts lawmakers are considering an estate tax reform measure which would raise the threshold at which someone becomes eligible to pay.

For estates of decedents dying in 2006 or after the. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents gross estate prior to deductions exceeds the threshold. Up to 100 - annual filing.

51 rows Heres how the actual calculation works. We have a simple process for getting you from wherever you are now to executed and final documents. A guide to estate ta mass gov massachusetts state estate tax law what.

778 NE2d 1039 Table Mass. The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the. The Massachusetts estate tax is an amount equal to the federal credit for state death taxes computed using the Internal Revenue Code Code as in effect on December 31.

The Massachusetts estate tax calculation is based on the federal credit for state death taxes. It starts with an initial consultation which is absolutely free. The Massachusetts estate tax threshold has been set at 1 million since 2006.

This tool is provided to help estimate potential estate taxes and. The Massachusetts estate tax law MGL. Massachusetts Estate Tax Table 2017.

2022 Massachusetts State Tax Tables. Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts. Massachusetts Estate Tax Table.

A guide to estate taxes Mass Department of Revenue The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate. Killing estate ta estate ta or inheritance tax debate. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976.

The Massachusetts estate tax is a. The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary. Masuzi March 3 2018 Uncategorized Leave a comment 52 Views.

Good news for small business owners. Masuzi July 19 2018 Uncategorized Leave a comment 8 Views.

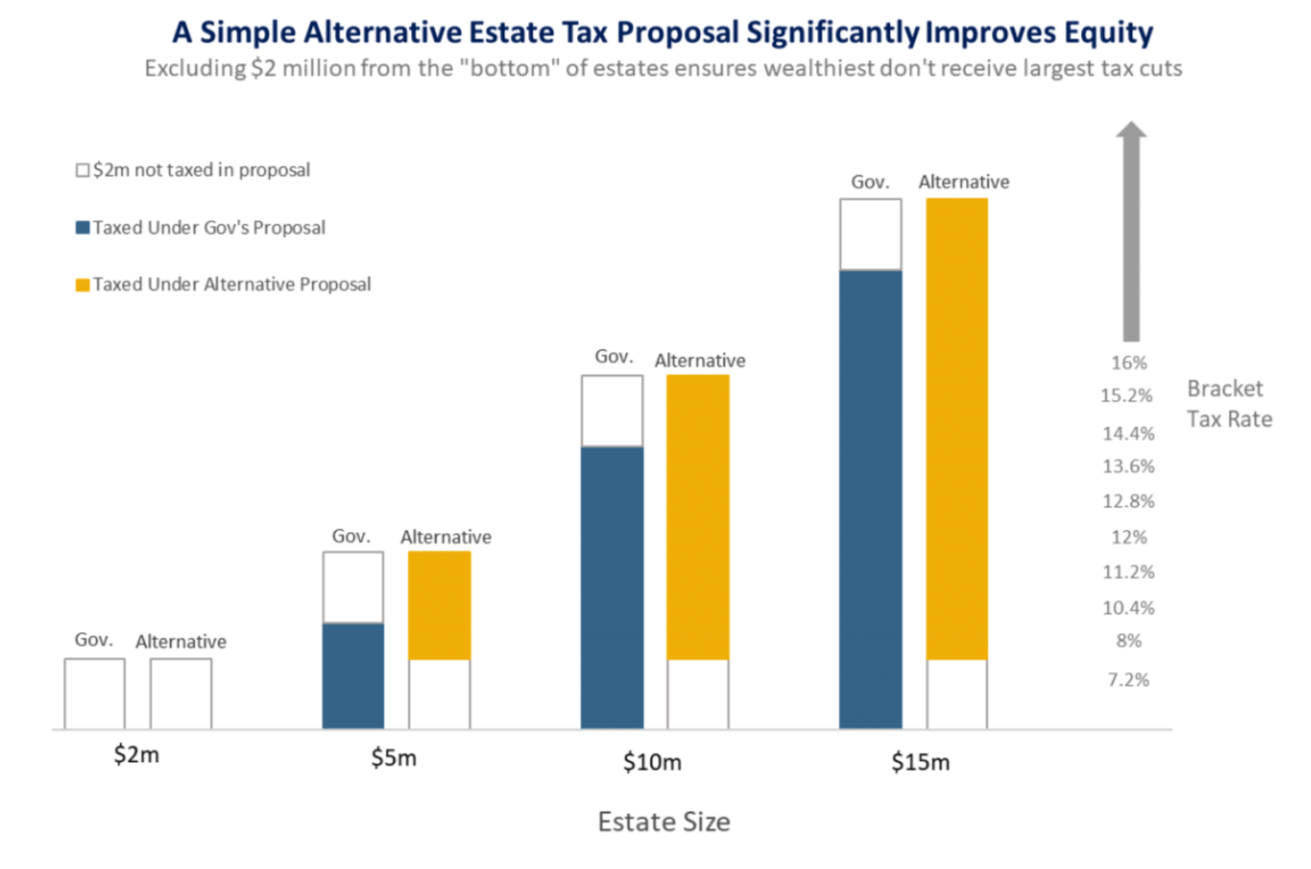

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

2022 Transfer Tax Explained Bove And Langa

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

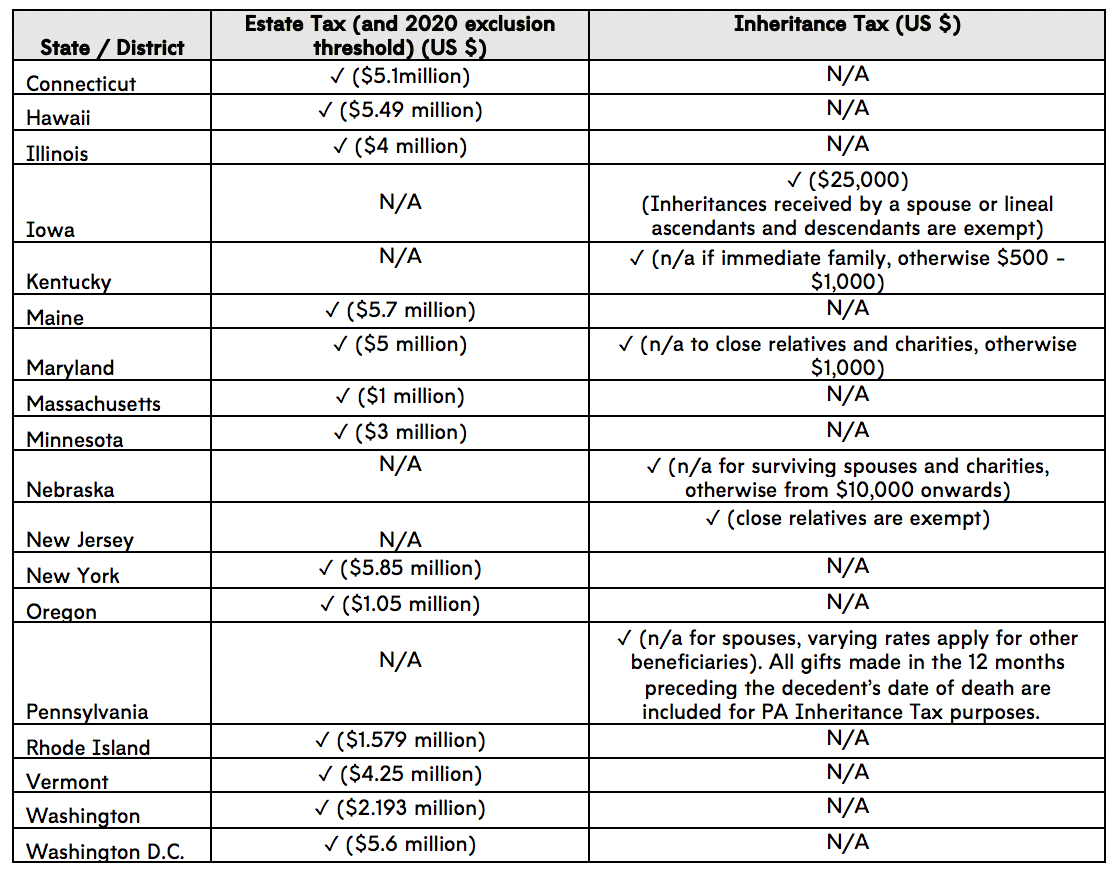

U S States Imposing Estate And Inheritance Taxes Asena Advisors

Massachusetts Inheritance Laws What You Should Know Smartasset

Is There A Federal Inheritance Tax Legalzoom

Massachusetts Income Tax H R Block

Estate Tax In Massachusetts Slnlaw

Massachusetts Estate Tax Everything You Need To Know Smartasset

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Crr Blog Accounting Tax Advisory Wealth Management Estate Tax

3 Ways To Avoid Estate Taxes In Massachusetts

How Much Money Can You Gift Tax Free The Motley Fool

Planning For Retirement How Attractive Is Massachusetts For Estate Tax Planning Don T Tax Yourself