student loan debt relief tax credit 2020

This bill establishes programs to cancel certain student loan debt and refinance student loans. Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better.

Student Loan Forgiveness Statistics 2022 Pslf Data

There were 5145 applicants who attended in-state institutions and will each receive 1067 in tax credits while 4010 eligible applicants attended out-of-state institutions and will each receive 875 in tax credits.

. ANNAPOLIS MDGovernor Larry Hogan today announced nearly 9 million in tax credits to more than 9000 Maryland residents with student loan 1. Failure to do so will result in recapture of the tax credit back to the State. Recipients of the tax credit must submit proof that they used the tax credit to pay down qualifying student loans.

Consumer Credit is a non-profit organization that provides credit counseling and debt management programs to millions of debtors nationwide. Your new tax bill would be 1000 taxes due 500 credit 500. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university.

Explore exclusive scholarships in California to forgive student debt. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate. The ARRA made a tax credit of up to 8000 available to first-time homebuyers purchasing a residence for up to 800000.

File Maryland State Income Taxes for the 2019 year. 2020-11The IRS had earlier provided relief for students from Corinthian College or American Career Institutes Inc. Here are the featured and popular login help you can get at Americas 1 Credit Tax Student Loan Debt Relief Program Reviews.

The IRS extended its safe-harbor relief from recognizing cancellation-of-debt COD income for students whose loans were discharged either because their schools were closed or as a result of some type of fraud Rev. Ad You Would Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program. If you receive a tax credit then you must within two years of the taxable year in which the credit is claimed submit to the Maryland Higher 2.

Tax Relief Expanded for Student Loan Debt Discharge in Certain Cases January 16 2020 by Ed Zollars CPA The IRS announced an expansion of relief to additional individuals who borrowed funds to attend school and later had that debt cancelled in. Ad Students at all education levels will be considered for the 10k Loan Relief Grant. CuraDebt is a company that provides debt relief from Hollywood Florida.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and Currently owe at least a 5000 outstanding student loan debt balance. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings income tax credit for Maryland resident taxpayers that are making eligible undergraduate andor education that is graduate re payments on loans acquired to make an. It was established in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators.

The student loan debt relief tax credit is a program created under 10 -740 of the tax -general article of the annotated code of maryland to provide an income tax credit for maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate. Until the end of 2020 employers can contribute up to 5250 toward an employees student loan balance and the payment will be free from payroll and income tax under a provision in the Coronavirus Aid Relief and Economic Security CARES Act PL. Maryland offers the Student Loan Debt Relief Tax Credit for students who have incurred at least 20000 in student loan debt and have a remaining balance of at least 5000.

A taxpayer could have modified adjusted gross income up to 125000 or. CuraDebt is an organization that deals with debt relief in Hollywood Florida. To qualify for the Student Loan Debt Relief Tax Credit you must.

Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan debt and provide proof of payment to MHEC. Incurred at least 20000 in total student loan debt.

If you owed 1000 in taxes and receive a 500 credit youd subtract the credit from your taxes due. Have at least 5000 in outstanding student loan debt remaining during 2019 tax year. Deductions reduce your taxable income while tax credits reduce the amount you owe in taxes.

You can be also given specific login instructions or something to note. About the Company Student Loan Debt Relief Tax Credit. In 2019 the state awarded nearly 9 million in tax.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. February 18 2020 842 AM. Last year MHEC awarded the Student Loan Debt Relief Tax Credit to 7962 Maryland residents.

Your savings is 500. IR-2020-11 January 15 2020 WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school. Student Loan Debt Relief Tax Credit for Tax Year 2020.

First the bill requires the Department of Education ED to automatically discharge ie repay or cancel up to 50000 of outstanding student loan debt for each qualified borrower. It was founded in 2000 and has been an active part of the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators. Submitted an application to the MHEC by September 15 2019.

Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. Governor Hogan Announces 9 Million in Additional Tax. Student Loan Debt Relief Act of 2019.

About the Company Student Debt Relief Tax Credit.

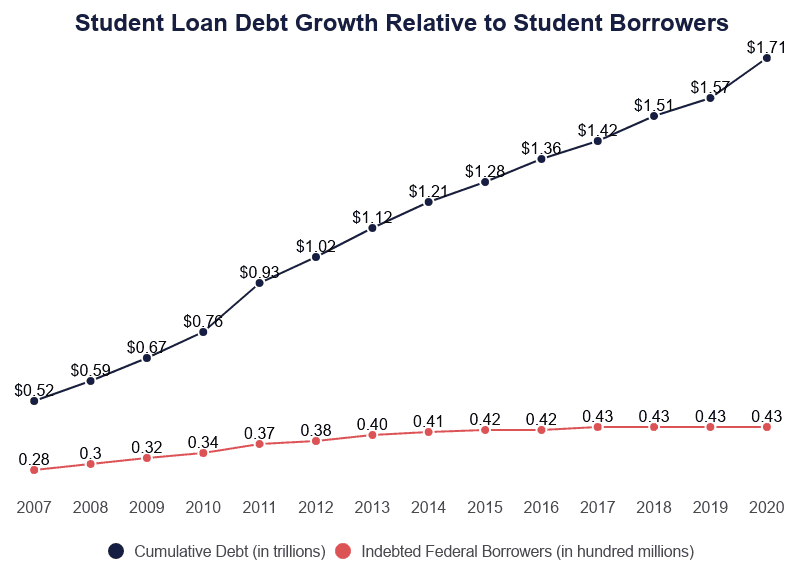

What Is The Current Student Debt Situation People S Policy Project

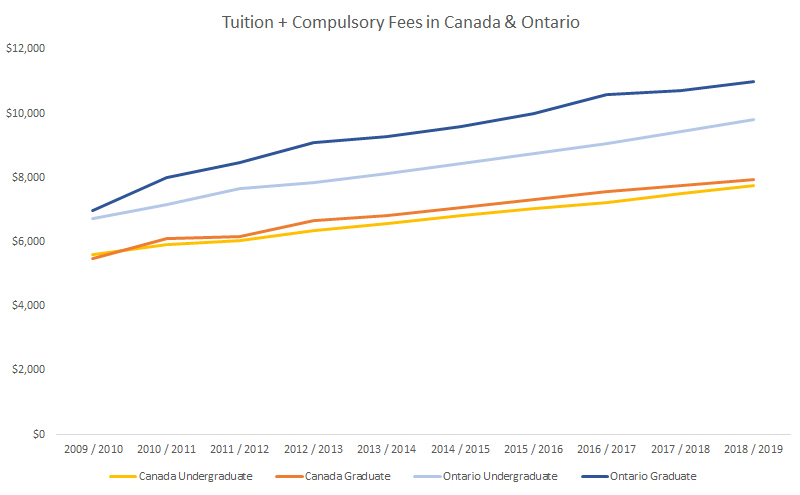

Student Loan Forgiveness In Canada Loans Canada

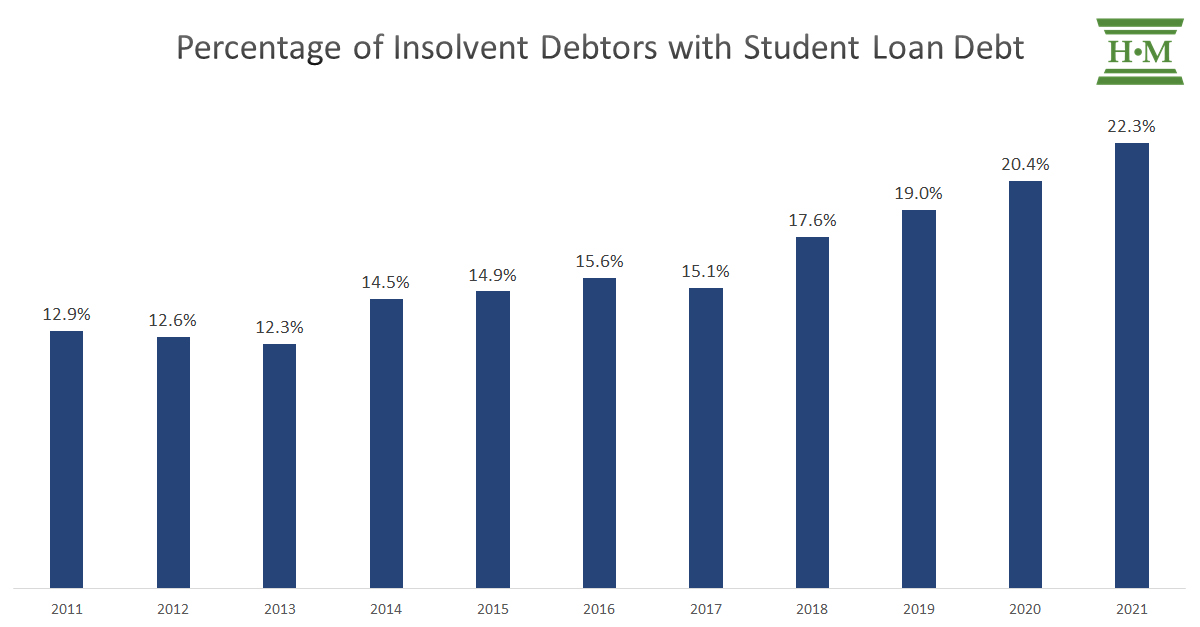

2021 Joe Debtor Bankruptcy Study Who Files Bankruptcy Why Hoyes Michalos

Is Taking On More Student Debt Bad For Students Econofact

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

Student Loan Debt Crisis In America By The Numbers Educationdata Org

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca

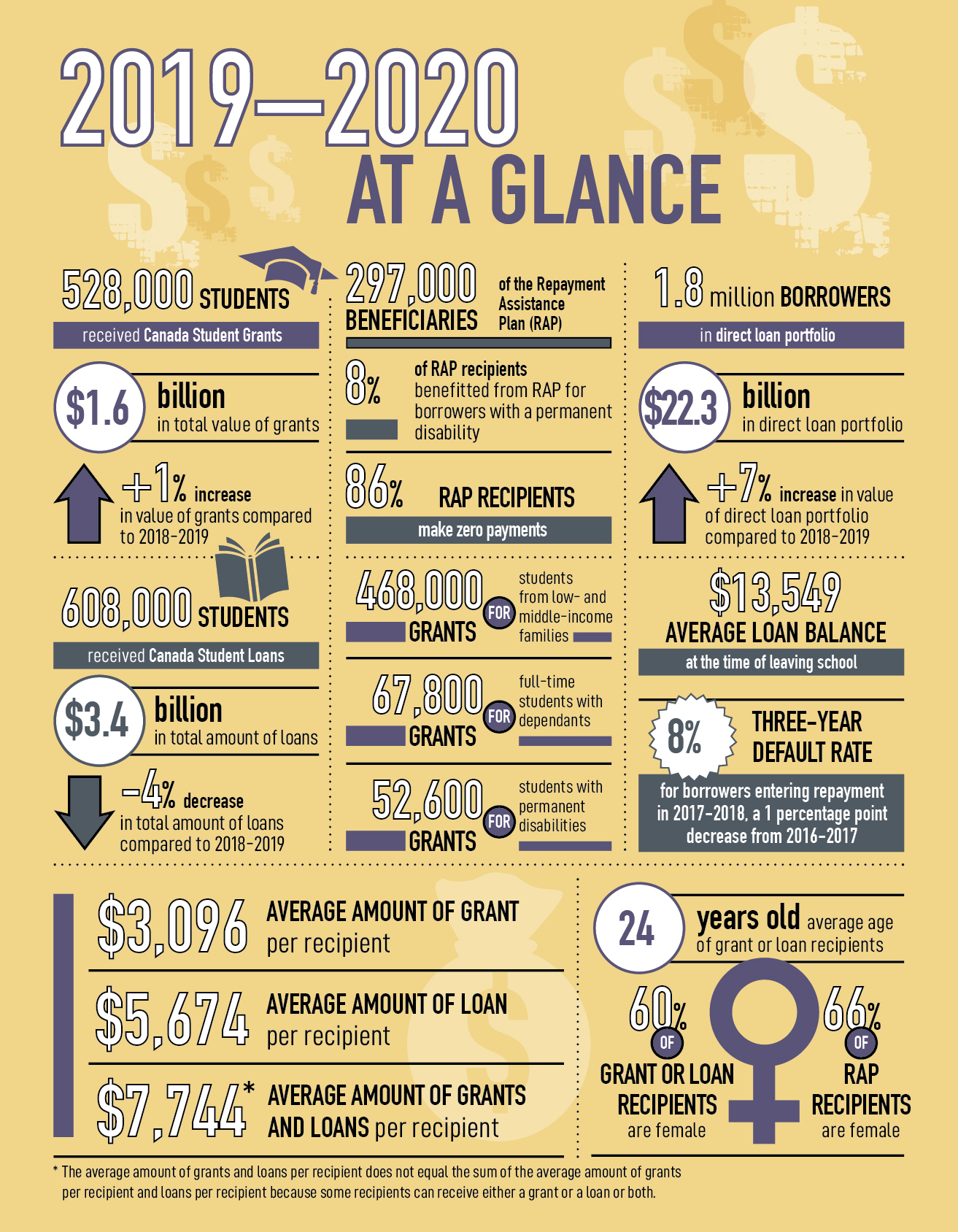

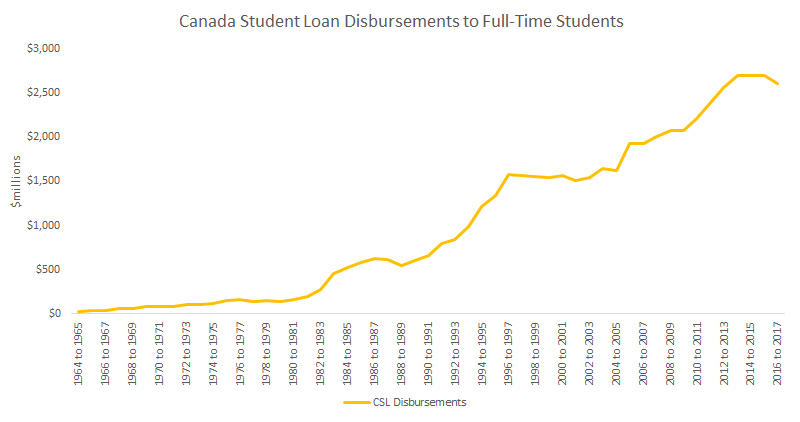

2019 To 2020 Canada Student Financial Assistance Program Statistical Review Canada Ca

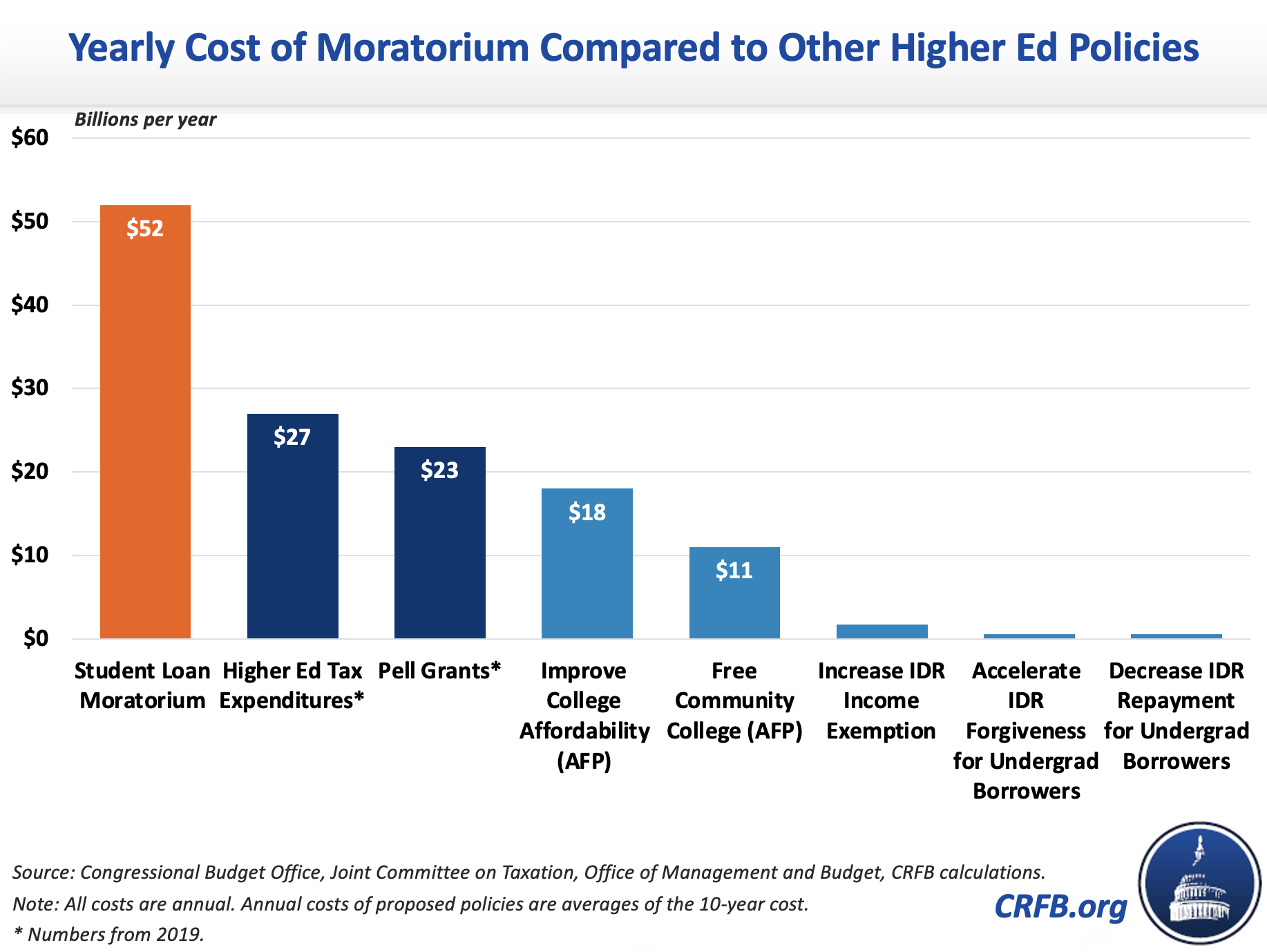

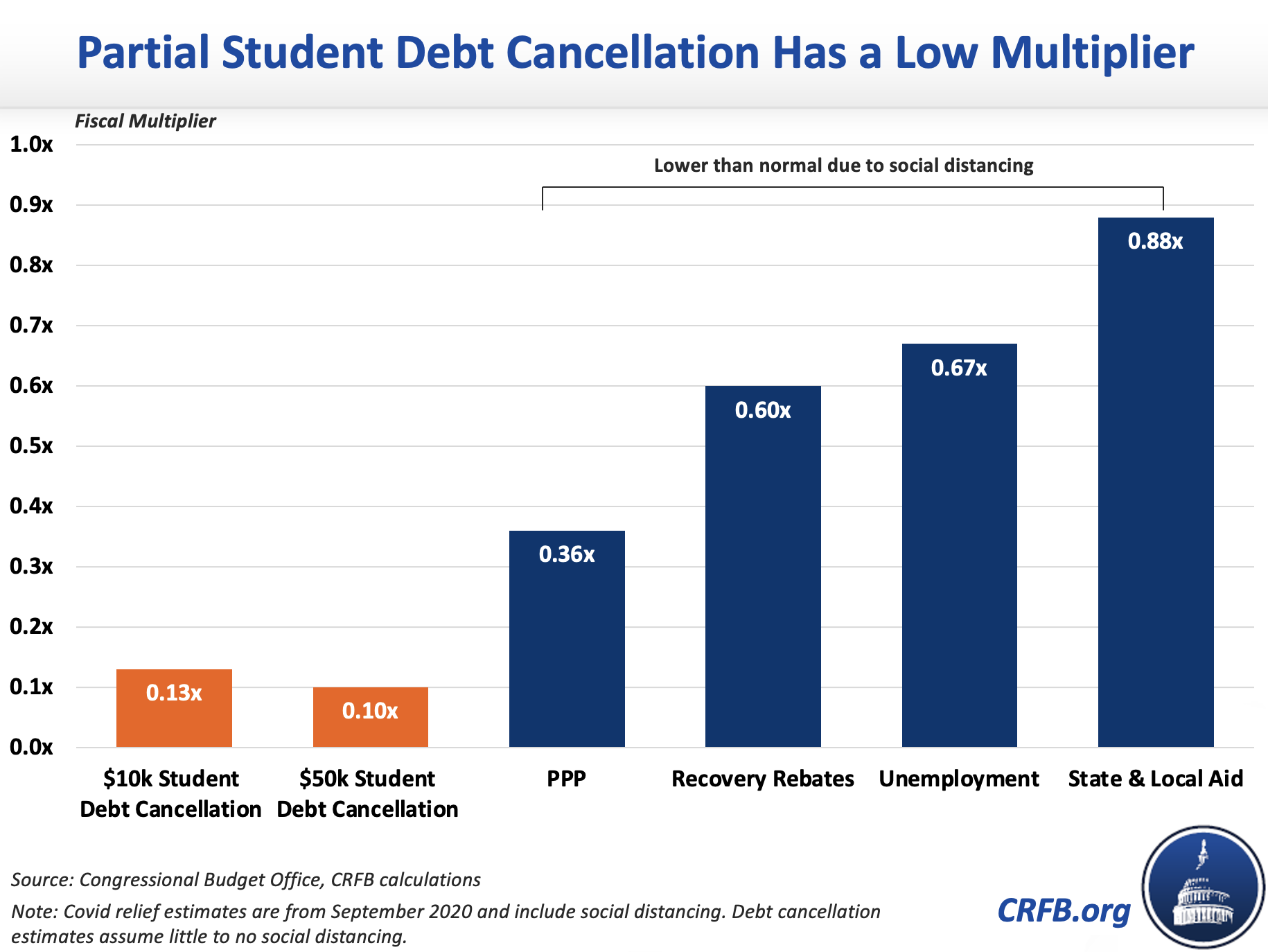

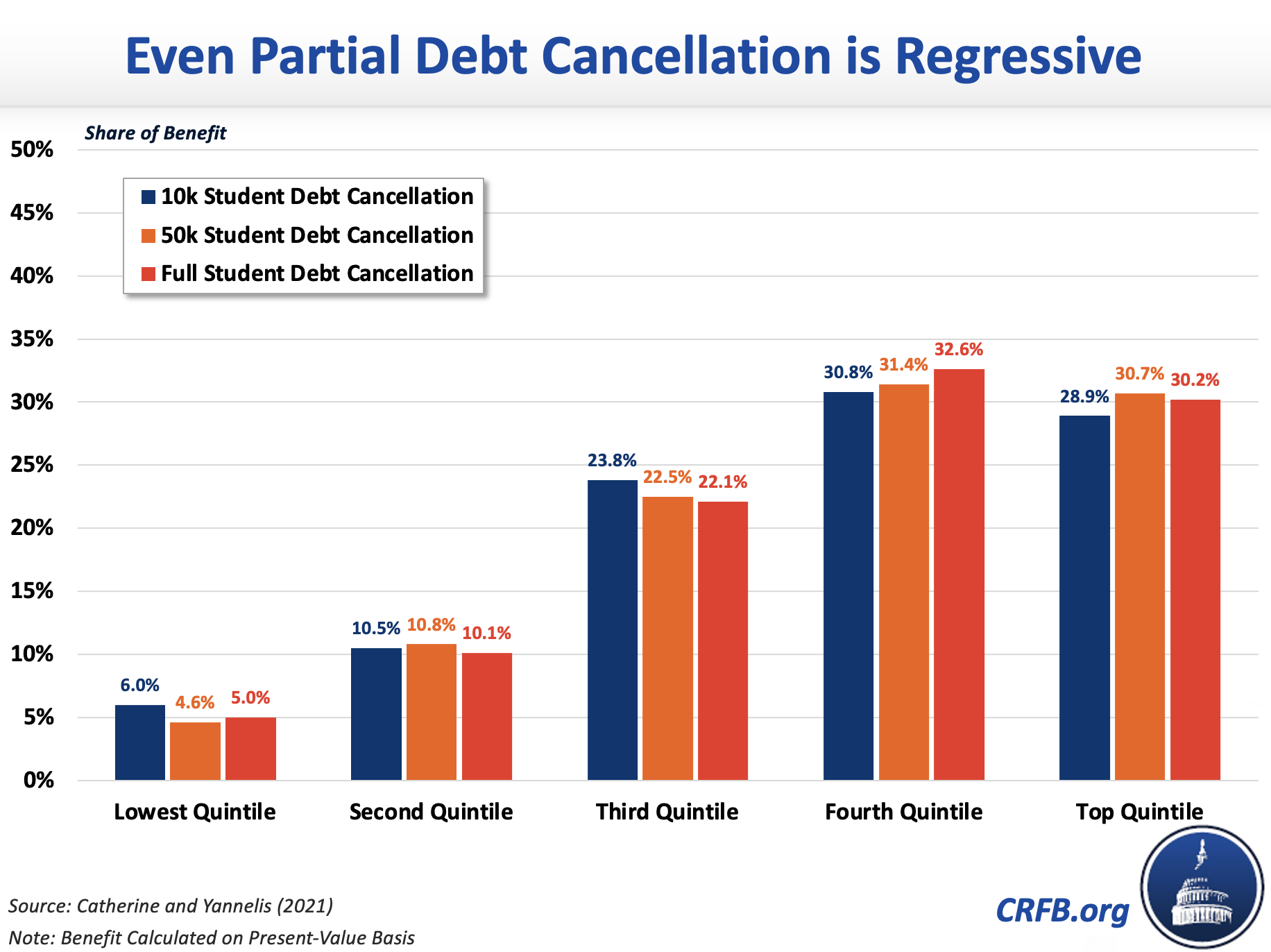

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

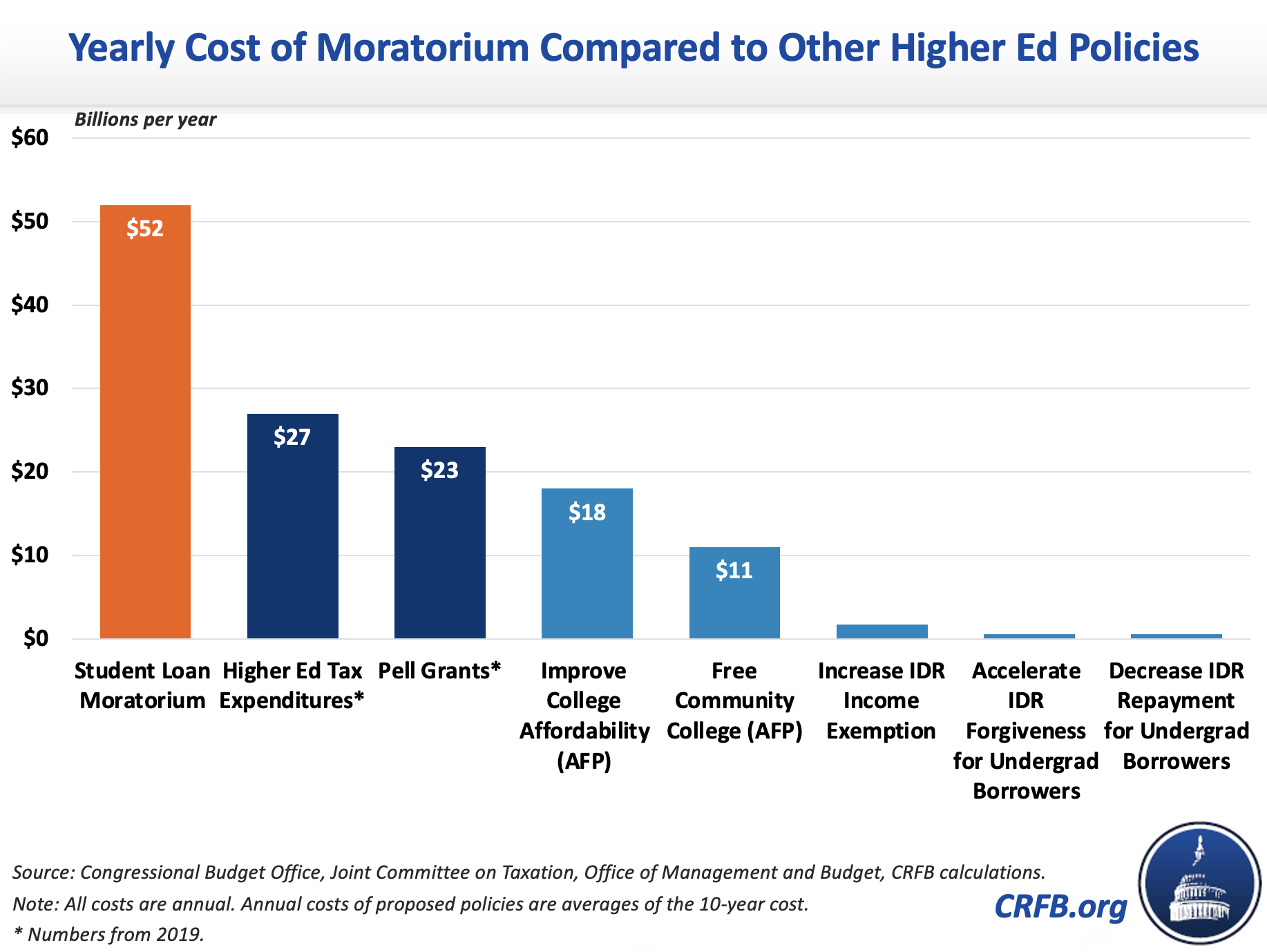

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

What Are The Pros And Cons Of Student Loan Forgiveness

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven